by Rick Pendykoski | Jan 24, 2022 | Uncategorized

If you are short on funds to deal with an emergency, you may have considered withdrawing from your 401(k). You must know that you cannot simply make a withdrawal from your 401(k) any time you’d like. A 401(k) retirement account is typically designed to allow you to withdraw at age 59½. If you take a distribution before that age, you are slapped a 10% penalty, plus income tax on the amount withdrawn. That being said, there are several specific circumstances when you can take 401(k) withdrawals to cover emergency costs. These exceptions are called hardship withdrawals.

However, before you consider taking a hardship withdrawal, you must know what it is, the pros and cons of it, and whether tapping into 401(k) early may be worth considering.

What is 401(k) hardship, and how does it work?

The IRS allows you to withdraw money from your 401(k) if your financial need is heavy and immediate. The IRS lists the following 401(k) hardship withdrawal reasons you can qualify for:

401(k) Hardship Withdrawal Rules

Not all 401(k) plans allow hardship withdrawals. When the employers set up the 401(k) plan for their employees, they also set the requirements for hardship withdrawals. So, it’s up to your employer and the plan custodian to approve your request for a hardship withdrawal. Unlike a 401(k) loan, you cannot repay a hardship withdrawal.

Taxes Affecting a 401(k) Hardship Withdrawal

401(k) hardship withdrawals are taxed as ordinary income. And if you are under age 59½, there is a penalty of 10% applied if you don’t qualify for an exception. If you are under 59½, you can avoid the 10% penalty if:

401(k) Hardship Withdrawal Limits

If you meet the criteria to qualify for a 401(k) hardship withdrawal, you need to determine how much money you can withdraw. In most cases, you are allowed to withdraw only what you need. For example, if your home repair cost after an earthquake is $15,000, you wouldn’t be able to withdraw more than that. However, you may be allowed to take additional funds to cover related costs, such as taxes on the withdrawal transaction.

In 2020, the CARES Act allowed individuals to withdraw up to $100,000 to cover COVID-related costs without the 10% early withdrawal penalty. The act also allowed individuals to make tax payments over a period of three years.

How to avail hardship withdrawals from 401(k)?

- Talk to your plan sponsor

Your plan sponsorcould be a human resources representative at your company or a financial advisor assigned to the plan. You can contact them to find out if you are eligible and provide the paperwork needed for a hardship withdrawal.

- Provide proof of hardship

In some cases, your 401(k) plan provider might ask for proof of hardship, which can include financial statements, a notarized statement from an accountant, or an eviction notice.

- Get approved for the withdrawal

Once your documents are verified, your plan administrator will give you the approval to make a hardship withdrawal.

Things You Should Know About Hardship Withdrawal

Before you decide to make a hardship withdrawal, there are a few things you need to consider:

Alternative to a 401(k) Hardship Withdrawal – 401(k) Loan

Depending upon your financial situation and the nature of your need, you may prefer taking a 401(k) loan than taking a hardship withdrawal from your 401(k) plan:

If your plan allows it, a 401(k) loan might be a more desirable alternative than a hardship withdrawal. If you take a 401(k) loan, you have to return the amount along with interest to the account. There is no tax implication if you repay the amount in full within the specified timeframe. If you leave your job before paying off your 401(k) loan, the loan balance is considered as a withdrawal that attracts tax and a 10% penalty if you are not age 59½ and above.

The Bottom Line

If you have to use your retirement saving before age 59½, a 401(k) loan might be a sensible option. But if your plan doesn’t allow borrowing, a hardship withdrawal can be a possibility. However, proceed with it only after understanding its underlying implications.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.

by Rick Pendykoski | Jan 24, 2022 | Uncategorized

What is a Crypto IRA?

Also referred to as Bitcoin IRA, Crypto IRA is a self-directed IRA, which allows you to invest in Cryptocurrency and other asset classes such as real estate and precious metals – the alternative assets that are not available with traditional IRAs.

Cryptocurrency is a digital asset. It has rapidly become a legitimate asset as financial institutions all over the world have warmed up to the idea of Cryptocurrency as a valid part of the overall financial system.

Investing in Cryptocurrency for retirement may not only give you a better return on investment but also provide broader diversification to your investment portfolio. However, not many investors are aware that it is possible to hold these digital assets in a self-directed IRA. Read on to know more about Crypto IRA, how it works, the benefits of Crypto IRA, its potential risks, and much more.

What are the Benefits of a Crypto IRA?

The IRS considers Cryptocurrency as property. Hence, it taxes Cryptocurrency as it would tax bonds, stocks, and other assets. When you invest in digital currency with a self-directed IRA, the capital gains grow tax-free. If your investment was with a Traditional IRA, your gains are tax-deferred until you take a distribution. In a Roth IRA, your gains grow tax-free, and your distributions at retirement are not taxable. Some benefits of Crypto IRA include:

- Diversification: Investing in Crypto adds diversification to your retirement portfolio. In case of a major market downturn or other tumultuous activity in the future, diversification can protect your retirement accounts.

- Future of Investing: Cryptocurrencies will become more popular and accessible in the future. It has a long-term outlook, and therefore IRAs can be an excellent investment vehicles to hold their potential on for decades.

- TaxBenefits: The IRS considers Cryptocurrencies as property for tax purposes. But if you use Traditional IRA or Roth IRA for Cryptocurrency investing, it can grow either tax-deferred or tax-free.

How Does a Crypto IRA Work?

A Crypto IRA works like a normal IRA. The only difference is that you are investing in Cryptocurrency instead of mutual funds or bonds. You can choose between traditional and Roth IRA to take advantage of their associated tax benefits. You can also rollover funds from a regular IRA to a self-directed IRA.

How to Invest in a Crypto IRA?

To hold Cryptocurrency in a retirement account, you must make the investment through an LLC. Here are the steps:

- Set up a self-directed IRA.

You need a custodian to establish a self-directed IRA and fund it. The custodian is responsible for its safekeeping and ensures that your account adheres to the rules set by the IRS and government.

- Form and register an IRA LLC.

The LLC will be 100% owned by the IRA. The income and expenses related to the asset must flow through the IRA LLC. Since the Cryptocurrency is owned by the IRA, the gains are tax-advantaged.

- The IRA LLC opens a business checking account.

The IRA LLC opens a checking account. You, as the account owner, will have check book control over all the transactions. You can use the funds in the IRA LLC’s checking account to invest in assets through self-direction.

- Open a Cryptocurrency exchange account in the name of the IRA LLC.

You can purchase or trade digital assets on exchange platforms. You can also purchase them by investing in a fund that holds various digital currencies or through brokers.

Potential Risks of a Crypto IRA

It’s important that you conduct full due diligence before investing in Cryptocurrency with an IRA. In addition to doing your research, it’s recommended to partner with a reputable and experienced self-directed IRA administrator to open your account and fund it. Some of the potential risks of Crypto IRA include:

How do Crypto IRA Taxes Work?

Crypto Investments in an IRA: Rules and Things to Consider

Some of the things you need to be aware of before making Crypto investments in an IRA include:

Invest in Your Future With a Crypto IRA

Investing in and trading Crypto is a lucrative way to diversify your retirement investment portfolio. Many people set up self-directed IRA to invest in Cryptocurrency. While Crypto is a riskier investment because of its high volatility, it has a promising future and tax advantages. If you are looking to capitalize on your income now and enjoy it later in retirement, Crypto IRA is a great choice. It is always wise to use the advice of a tax professional before setting out on your own.

Also Read: What is a Gold IRA & How Does it Works?

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.

by Rick Pendykoski | Nov 15, 2021 | Uncategorized

A Roth IRA is an excellent tool to put away money for your retirement. However, like all other tax-advantaged retirement plans, there are some rules regarding the taxation of contributions and withdrawals. There are income limits for participating in these plans and also limits on how much you can contribute in a given year. It’s important that you understand the impact these rules can have on your retirement savings. Read on to know more.

A Roth IRA is similar to a traditional IRA; the difference is, however, in their tax treatments. Traditional IRAs are tax-deferred, while Roth IRAs are funded with after-tax dollars. As a result, Roth IRA contributions aren’t deducted from your taxable income. However, the biggest benefit is that you can make tax-free withdrawals in your retirement.

Roth IRA Eligibility Rules

| Roth IRA Eligibility Rules for 2022 |

Roth IRA Eligibility Rules for 2023 |

| You (and/or your spouse) have earned income of at least the amount of total contributions. |

You (and/or your spouse) have earned income of at least the amount of total contributions. |

| No age limit |

No age limit |

|

Your tax filing status and modified adjusted gross income (MAGI) decide whether or not you can make a full contribution to your IRA:

Full contribution:

- Single: If MAGI is less than $129,000

- Joint: If MAGI is below $204,000

Partial contribution:

- Single: If MAGI is between $129,000 and $144,000

- Joint: If MAGI is between $204,000 and $214,000

No contribution:

- Single: If MAGI is over $144,000

- Joint: If MAGI is over $2144,000

Married but filing separately (living with your spouse anytime during the tax year):

- Partially deductible for MAGI up to $10,000

- No deduction for MAGI more than $10,000

Married but filing separately (didn’t live with your spouse during the tax year):

- Your filing status is considered single for IRA contribution purposes

|

Your tax filing status and modified adjusted gross income (MAGI) decide whether or not you can make a full contribution to your IRA:

Full contribution:

- Single: If MAGI is less than $138,000

- Joint: If MAGI is below $218,000

Partial contribution:

- Single: If MAGI is between $138,000 and $153,000

- Joint: If MAGI is between $218,000 and $228,000

No contribution:

- Single: If MAGI is over $153,000

- Joint: If MAGI is over $228,000

Married but filing separately (living with your spouse anytime during the tax year):

- Partially deductible for MAGI up to $10,000

- No deduction for MAGI more than $10,000

Married but filing separately (didn’t live with your spouse during the tax year):

- Your filing status is considered single for IRA contribution purposes

|

Roth IRA Income Limits

To make a Roth IRA contribution in 2023:

Required Minimum Distributions (RMDs)

Traditional IRAs need you to take required minimum distributions (RMDs) after you turn age 72. Even if you don’t need the money, you have to take it if you don’t want to pay taxes on it. With Roth IRAs, you are not required to take RMDs. This means if you don’t need the money, you can let it grow tax-free, allowing more flexibility into your long-term plans.

Roth IRA 5-Year Rule

In this section, we cover three Roth IRA 5-year rules:

Qualified Distributions

Qualified distributions from Roth IRA include distributions taken:

Non-Qualified Distributions

A non-qualified distribution from a Roth IRA include distributions taken:

Roth IRA Withdrawal Rules by Age

|

Under 59.5 |

Over 59.5 |

| If you meet the 5-year rule |

Withdrawal of earnings is subject to taxes and penalties. You may be able to avoid these if you:

- Use the money to buy your first home

- Have a permanent disability

- Pass away. Your beneficiaries can avoid taxes and penalties.

|

No taxes or penalties |

| If you don’t meet the 5-year rule: |

Withdrawal of earnings attracts penalties and taxes. You can avoid these if you:

- Use the money to buy your first home

- Use the money to pay for qualified education expenses

- Use the money to pay for unreimbursed medical expenses

- Have permanent disability

- Pass away. Your beneficiaries can avoid taxes and penalties.

|

Earnings attract taxes but not penalties. |

Tax Breaks for Roth IRA Contributions

Contributions to Roth IRAs are made of after-tax money. That’s the reason why you don’t pay tax when you withdraw them. That said, you may also be eligible for a tax credit of 10% to 50% on the amount contributed to a Roth IRA. This tax break is called the Saver’s Credit. Taxpayers in the low- and moderate-income groups qualify for this tax break. The tax credit is up to $1,000 and depends on three things: adjusted gross income (AGI), your filing status, and Roth IRA contribution. However, there are some limits to qualify for this tax break for the tax year 2021:

First-Time Homebuyer Exception

If you want to buy, build or rebuild your first home, the IRS allows you to take up to $10,000 in tax- and penalty-free distribution from your Roth IRA even before you turn 59.5.

Higher Education Expenses

You can use your Roth IRA distribution to pay for higher education expenses without incurring the 10% early withdrawal penalty, even if you make the distribution before you reach age 59.5. However, the withdrawal amount is subject to income tax.

Special Changes in 2020

In 2020, CARES Act was introduced to provide relief to those affected by the coronavirus pandemic. The Act allowed a hardship distribution of up to $100,000 without a 10% early withdrawal penalty, which is normally charged if the distribution is taken before age 59.5.

However, the withdrawals are subject to tax. That said, the Act gives three years for the account holders to pay the tax owed on such withdrawals, which they are normally required to pay in the current year. They can also choose to repay the withdrawal amount and avoid paying the tax, even if the amount exceeds the annual contribution limit for that retirement plan.

By understanding the different Roth IRA rules, you’ll have a better understanding of how these rules affect your retirement savings and your future retirement goals. If you’re still confused, speaking to Rick might help. Contact him now!

FAQs

Can you lose money in a Roth IRA?

Yes, you have the flexibility to invest your IRA funds in a range of options, but it’s essential to be aware that certain investments may experience a loss in value, particularly in the short term. It’s crucial to assess your risk tolerance and understand the level of risk you are comfortable with when selecting investments for your IRA

Should you contribute to a 401(k) or a Roth IRA?

Both a 401(k) and a Roth IRA are beneficial tools for saving for retirement, and the great news is that you don’t have to pick just one. If you meet the eligibility criteria for a Roth IRA, you have the option to contribute to it in addition to participating in an employer-sponsored retirement plan like a 401(k). However, it’s important to note that contributing to both requires having enough funds available, which may not always be feasible for everyone.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.

by Rick Pendykoski | Nov 15, 2021 | Uncategorized

Maxing out your 401(k) contributions is a good thing. It means that you are making the most out of your employer-sponsored retirement account to enjoy worry-free golden years. Over contributing to your 401(k) isn’t allowed, but it’s easy to do it by mistake. If you have contributed too much to your 401(k), there are consequences that we’ll discuss in this article. Also, find out what investment options you have to park your excess funds.

Did you contribute too much to a 401(k)?

In most cases, you do not have to be concerned about over contributing to your 401(k) because your plan administrators already have a protocol in place to avoid it from happening. However, even with these mechanisms in place, there is a possibility of over contributing in a calendar year, especially if you have switched jobs and did a rollover from your previous company retirement account to a new account. If you over contribute to your retirement account, it’s difficult to find the miscalculation until it’s too late – you will end up paying tax twice on the same amount of money – you’ll get taxed on your income earned and also when you make withdrawals from your retirement account. If you want to avoid this, you need to correct the excess contributions before the tax deadline of the following year. You may have to include the dollar amount you over contributed and account for investment earnings.

401(k) Contribution Limits for 2021 and 2022

- For 2021, your individual 401(k) contribution limit is $19,500, or $26,000 if you’re age 50 or older.

- For 2022, 401(k) contribution limits for individuals are $20,500, or $27,000 if you’re 50 or older.

What should you do if you’ve over contributed to your 401(k)?

If you find that you’ve over contributed your 401(k), the first thing you should do is inform your plan administrator. Once that’s done, correcting the over contribution error may take time. Your plan administrator must distribute the excess deferral and earnings associated with these funds by a certain date as stated in the 401(k) plan. The calculation of earnings is based on the total change in account value since the over contribution. It’s important to complete this process before April 15 of the year after the over contribution is made. Once the mistake is corrected, you’ll get new tax forms from HR. You’ll receive an amended W-2. The new W-2 will reflect the increase in taxable wages, which is equal to the over contribution amount. This number must be reported to the IRS on form 1040 for the year of the corrected W-2. If you’ve filed taxes for that year already, you need to file an amended return. You’ll receive a 1099-R for the distribution of earnings associated with your over contribution. You’ll receive this in January of the year following the year the over contribution was paid back. If you don’t catch and rectify the over contribution mistake before the tax day of the year following the over contribution, your 1099-R might of a much higher amount. That’s because the 1099-R will reflect the total distribution, including the over contribution amount instead of reflecting only the earnings on the over contribution. This means you’ll be effectively taxed twice on the same income – once in the year you earned it and also in the year you corrected the over contribution. That’s not all. If you are younger than 59 ½, you’ll also be penalized a 10% early distribution penalty.

Where to put your money instead of over contributing to 401K?

Here are a few options to consider:

- Individual Retirement Account (IRA): Although IRAs offer similar benefits to a 401(k), they give you more control over your investment options. You can practically invest in everything your IRA broker offers.

- A traditional (non-tax-advantaged) brokerage account: The benefit of putting money in a traditional brokerage account is that you can use the money for whatever purpose you like. The downside is that you won’t get a tax break and will be liable for taxes on your investment gains each year.

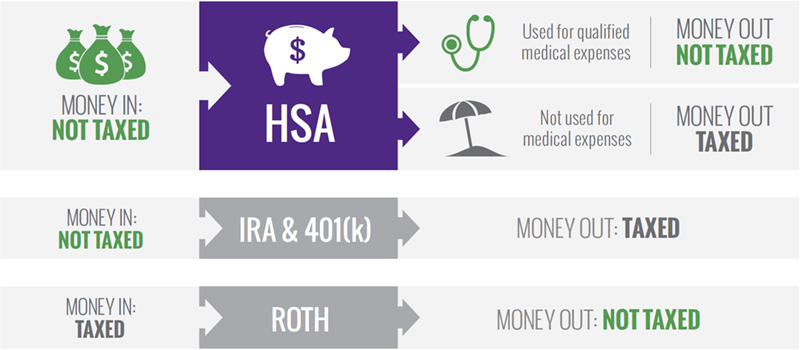

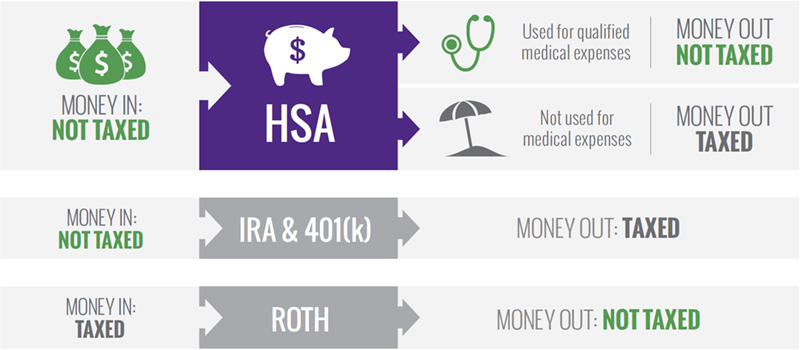

- Health Savings Account (HSA): An HSA combines both savings and investment. It allows you to set aside money that can be used to cover your healthcare expenses. Your contributions to an HSA grow tax-free.

Image credit: blog.healthequity.com

- Annuity: This is a contract made between you and an insurance company. A lump sum upfront is given to the issuer of the annuity. The issuer then agrees to pay you either a series of payments over time or a lump sum in the future.

If you have maxed out your 401(k) and still have money to spare, you are fortunate to be in a very good financial position. You can put the extra cash to good use by investing it into HSA, IRA, traditional brokerage account, or annuity – all are reasonable options. If you are worried about over contributions, get in touch with your plan administrator. If you want to discuss your worries or want to figure out the best option to invest your extra cash, get in touch with Self Directed Retirement Plans LLC.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.

by Rick Pendykoski | Oct 12, 2021 | Uncategorized

What is Marginal Tax Rate?

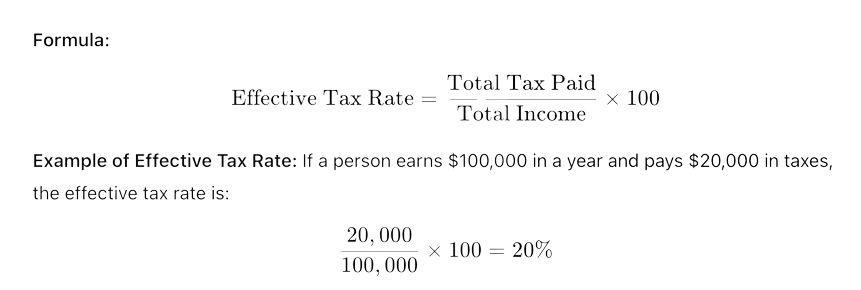

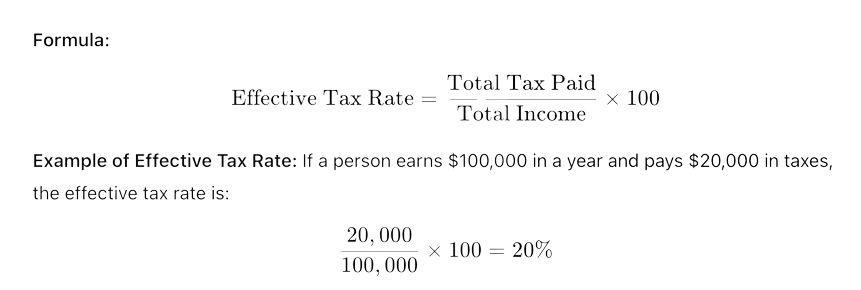

An effective tax rate is the share of total income that an individual or business pays in taxes. It simply points out how much tax is paid compared with the total income, giving a straightforward view of the burden of tax.

Formula to calculate Marginal Tax Rate

This means 20% of the person’s income goes to taxes.

What is Marginal Tax Rate?

The marginal tax rate is the rate at which the last dollar of income is taxed. Such a rate therefore represents what tax rate is applied on the highest portion of an individual’s or business income, and the progressive system taxes higher income levels at higher rates.

Example of Marginal Tax Rate: If a person’s income is taxed in various brackets, then the last $10,000 taxed at a 30% rate, then 30% is their marginal tax rate.

Difference Between Effective Tax Rate and Marginal Tax Rate

Definition: Effective tax rate is defined as total tax as a percent of total income. It is the tax payable on total income, whereas the marginal tax rate is the tax rate applied to the last portion of income.

Purpose: Effective tax rate helps to calculate the average tax burden, while marginal tax rate determines the tax rate for every dollar earned beyond the previous one.

Impact: The effective tax rate is usually lower than the marginal tax rate because not everything is taxed at a top rate.

The United States has a progressive tax system. What this means is the more money you earn, the more income tax you will pay. There are currently seven tax brackets ranging from 10% to 37%.

If you are single and earn $35,000 per year, your tax rate is 12%. If you are single and earn $520,000 you are in the top bracket which is 37%. These rates are Marginal Rates, and this is what most people are referring to when they say what their income tax rate is. However, this is where the confusion begins.

Marginal rates apply to each additional level of income earned. Meaning the first level of income is taxed at the lowest rate and this increase as your income increases. This illustration shows how a single taxpayer earning $100,000 works.

| Tax Bracket |

Amount |

Tax |

| 10% Bracket on the first |

$9,950 |

$995.50 |

| 12% Bracket on (40,525 – $9,950) |

$30,750 |

$3,669 |

| 22% Bracket on (86,375 – 40,525) |

$45,850 |

$10,087 |

| 24% Bracket on (100,000 – $86,375) |

$13,625 |

$3,270 |

| Total Tax |

$18,021.50 |

In this case, the Marginal rate was 24% But the Effective rate was 18%!

This example did not include Capital Gains Tax – an only tax on earned income.

Capital Gains are taxed differently

Short Term (less than one year) is treated as normal income.

Long Term (longer than one year) taxed at 0%, 15% and 20%.

Although most people talk about their Marginal Rate it is the Effective Rate that really affects your pocketbook.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.

by Donnell Stidhum | Sep 18, 2021 | Uncategorized

Can you roll over a pension plan into an IRA? Yes, provided it meets two criteria: the pension plan is a “qualified employee plan” (if you’ve been deferring tax on your contributions, your plan is most likely a qualified plan), and you must have left the company or your employer intends to close the pension plan.

What to Consider Before a Pension Rollover to an IRA?

There are several factors you should consider when deciding to roll over your pension plan to an IRA.

- What are your investment goals, time horizons, and risk tolerance?

An IRA offers a wide variety of investment options that a company pension plan doesn’t. You are not limited to stocks, mutual funds, and bonds; you can choose a wide variety, including real estate and precious metals, among others. You can decide on the investment types after considering your investment goals, risk tolerance, and time horizon.

- When do you plan to retire?

A company pension plan allows you to take a distribution from your retirement account at age 55 under certain circumstances. However, if you do a rollover to an IRA, you are now subject to IRA rules meaning you can take a penalty-free distribution only after you are 59 ½. If you take it before 59 ½, you will have to pay a 10% penalty on the distribution.

Does your company pension plan also include the distribution of the company’s stock?

If your pension plan includes company stock, you may want to take the distribution of the company stock only after you retire and when you are in a lower tax bracket. If you take a distribution before you are 59 ½, you’ll have to pay a 10% penalty and tax on your distribution. If you take a distribution after 59 ½, the 10% penalty will be excluded, but your distribution will be taxed as regular income.

Pros and Cons of Rolling Over a Pension Into an IRA

Rolling Over a Pension Into an IRA: The Pros

Some of the biggest benefits of rolling over your pension plan into an IRA include:

- You have a vast range of investment options.

An IRA gives you the freedom to invest in a wide range of traditional investments such as stocks, mutual funds, bonds, index funds, etc., which are not available with pension plans. You can also look at nontraditional (alternative) investments such as a real estate for the first time. You can choose the investments according to your risk appetite and preference.

- You have better withdrawal flexibility.

Pension plans usually have limitations on when and how to make the withdrawal. However, a rollover of your pension plan into an IRA gives you greater flexibility. You can withdraw funds before retirement and as many times as you want. However, withdrawing before retirement can attract taxes and penalties.

- You avoid paying taxes.

Rolling over your pension directly to a traditional IRA will not attract taxes or penalties on the distribution. However, if you roll over to a Roth IRA, it will be taxed, but the withdrawals from a Roth IRA are tax-free.

- You have greater control

With an IRA, you have greater control over your savings. You have the choice to decide where to open an IRA and figure out the best asset allocation in your portfolio based on your risk profile. Even if you change jobs, you can keep your IRA account while continuing to save for your retirement.

Rolling Over a Pension Into an IRA: The Cons

Although the benefits are many, the rollover of your pension plan into an IRA has a few disadvantages as follows:

- You don’t have an option to take a personal loan.

When you roll over your pension to an IRA, you lose the ability to borrow from your retirement savings. If you are in urgent need of money, you are left with the option of making an early withdrawal, which attracts a 10% penalty plus tax.

- You cannot take a distribution before 59 ½.

With the pension plans, you can take a distribution without penalty when you retire or leave the company at age 55. But when you roll over your pension plan to an IRA, you must wait until you reach 59 ½ to take a penalty-free distribution. If you take a distribution before age 59 ½, you must pay a 10% penalty on the withdrawn amount, losing a significant amount of your retirement money.

- You lose creditor protection.

Your retirement savings in a retirement plan are creditor protected. This means that your creditors cannot take your funds in bankruptcy situations or during collection. However, when you roll over the funds into an IRA, you lose that protection.

How to Rollover a Pension Plan

Some of the key methods of a rollover to an IRA include:

- Direct Method – The rollover into an IRA is extremely simple if you do it through the direct method. You just :

- Set up an IRA.

- Request your employer to prepare the paperwork required to start the rollover process.

- Request your IRA custodian to initiate a “direct” rollover. This ensures that money is directly transferred from one account to the other.

- Indirect Method – In the indirect method, you have the amount in the pension plan is directly paid to you. However, you have 60 days to redeposit the money into an IRA; otherwise, it will be considered as a distribution, and you will be charged a penalty of 10%, plus tax if you are under 55. Moreover, the plan administrator will withhold 20% of the account balance as tax to be sent to the IRS. This money is later credited as a tax credit.

- Lump Sum Payout – If you are 55 or older when the plan is closed, or you leave the company, you can take the pension as a lump sum distribution. This will not trigger the 10% early withdrawal penalty. However, the distribution will be considered as ordinary income, and tax will be charged the year you take the money.

Benefits of Rolling Over to a Self-Directed IRA

Here are a few reasons why a self-directed IRA is a great option if you need to roll over your pension or any eligible 401(k):

- Better investment options, such as real estate, startups, peer-to-peer lending, etc.

- When you own a wide variety of asset classes, you improve your ability to withstand market volatility.

- You are in control of your investment portfolio.

If done correctly, rollovers of pension plans are tax neutral. If done incorrectly, there’s a risk of the IRS taking a slice of your pension pie. If you want to do it right, get in touch with a financial expert who can do the rollover correctly with reduced tax implications.

My goal is to assist clients/investors in their quest for financial freedom and creating generational wealth through one on one consultation and an abundance of online tools to educate. For the past 5 years I have been a private pension plan consultant with Self Directed Retirement Plans working directly with my partner Rick Pendykoski (owner) or you can .