What is a 401(k) Plan and How Does a 401(K) Work?

A 401(k) plan is a retirement savings option provided by employers. It is a commonly included benefit in employment packages, allowing employees to allocate a portion of their salary into a designated 401(k) account, adhering to yearly contribution limits. Employers may also offer matching contributions to augment employee savings.

The 401(k) plan allows an employee to contribute a portion of his/her salary into long-term investments. The employer may match the employee’s contribution up to a certain limit set by the IRS. However, this retirement account is funded through pre-tax payroll deductions.

These plans offer a convenient way to save for retirement because the contributions are automatically withdrawn from the paycheck and invested in funds of your choosing.

401(k) Contribution Limits

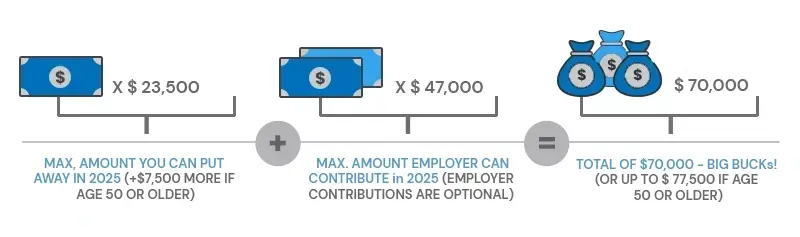

Whether traditional or Roth, an employee can defer a maximum of $23,500 for 2025 ($23,000 for 2024, $22,500 for 2023, $20,500 for 2022) from his/her salary to a 401(k) plan. For employees aged 50 years or older, an additional catch-up contribution of $7,500 ($7,500 for 2024, 23 and $6,500 for 2022) is allowed and those who turn 60, 61, 62, or 63 in 2025 can contribute an enhanced catch-up amount of $11,250.

An employer and employee can make a maximum joint contribution of $70,000 for 2025 ($69,000 for 2024, $66,000 for 2023, $61,000 for 2022), or $77,500 for those 50 years and above ($76,500 for 2024, $73,500 for 2023, $67,500 for 2022).

401K contribution limits and how much you can contribute to it.

Types of 401(k) Plans

There are various types of 401(k) plans, each with its own set of unique advantages and disadvantages. Some of these plans are:

Traditional 401(k)

Roth 401(k)

Simple 401(k)

Solo 401(k) or Self Employed 401(k)

Safe Harbor 401(k)

403(b) – non-profit organizations or government agency

Profit-Sharing Plans

401(K) Benefits

The benefits of investing in a 401(k) plan are:

Get Max benefit of 401(k) Now

How to Open/Setup a 401(k) Plan

Employer

As an employer or a self-employed individual, you can set up a 401(k) plan in the following steps:

Employee

If your company offers a 401(k) plan, you may be eligible to participate in it. If you are 21 years and above and have been working with the current employer for at least a year, you become eligible for it right away. So check up with your human resources department regarding your eligibility. If you are eligible to participate in a 401(k) plan, these are the step you should take:

Rules for Withdrawing Money

401(k) Hardship Withdrawal

The IRS imposes a 10% penalty for early withdrawal from your 401(k) plan if you are younger than 59 1/2 years. However, you can make a hardship withdrawal to cover the following expenses if your employer permits it:

- Medical expenses incurred by you, your spouse, or your dependents.

- College tuition and other associated educational fees for you, your spouse, children and dependents

- Costs associated with the purchase of your principal residence, not mortgage payments

- Some expenses incurred for repairing the damage to your principal residence

- Costs required to prevent being evicted from your home or foreclosure on your principal residence

- Funeral expenses

To qualify for 401(k) hardship withdrawal, you have to provide financial proof to your employer that indicates your need to take money out of your 401(k). If you don’t want to disclose your finances, you have an alternative to “self-certify.” Once you withdraw from your 401(k) on the basis of a hardship withdrawal, you won’t be able to make new 401(k) contributions for the next six months.

Check with your HR department to see if they allow hardship withdrawals and whether you qualify.

Penalty-Free 401(k)/Non-Financial Hardship 401(k) Withdrawal

A penalty-free withdrawal allows you to withdraw money before age 591/2 without paying a 10% penalty, but your withdrawal is taxable. To qualify for penalty-free withdrawal, you need to meet any of these situations:

- You need to have a disability that qualifies you for this type of a withdrawal

- Your medical expenses are up to the amount that is allowed as a medical expense deduction

- You are ordered by the court to give money to your divorced spouse, your child or dependent

- You’ve experienced a disaster for which the IRS has granted relief

- You’ve left the company and have set up a schedule to make equal periodic payments for at least 5 years or until you turn 591/2 years, whichever is longer

Contact your HR department to check whether your employer allows such kind of withdrawals and if yes, how you should proceed.

401(k) Required Minimum Distributions (Post-Retirement Rules)

In April the year after you turn age 72, you have to start taking 401(k) withdrawals, regardless of whether you want it or not. If you miss taking these required minimum distributions, or if you withdraw the wrong amount, the IRS will penalize you.These RMDs are calculated based on your life expectancy. Your plan administrator must determine your RMD. So, check the IRS’ RMD rules to determine your required minimum distribution.

401(k) Distributions in Retirement

Once you turn 59 1/2, you can start making withdrawals. You can typically take a periodic distribution or a lump sum distribution. The key here is to manage your distributions so that you don’t outlive your money. Although a lump sum gives you access to a larger amount of money, it is taxable, and you have to pay the tax right away. Moreover, it takes away a major chunk from your nest-egg, all at once. If you do not wish to withdraw a lump sum, and if your company allows, you can choose to receive a certain amount of money every month or every quarter. If you want to change the amount, you can do so once in a year. However, there are some plans which allow you to make changes more frequently.

Loans From a 401(k) Plan

You can take a loan from your 401(k) plan, provided your employer approves it. If you are eligible for this option, you can borrow up to 50% of the vested balance up to a limit of $50,000. The loan usually has to be repaid within 5 years, but a longer repayment period is allowed for a primary home purchase.

The interest rate that you pay to yourself for borrowing the money from your 401(k) plan will be comparable to the interest rate charged by the banks and lending institutions for a similar type of loan.

If you fail to repay the borrowed amount, the unpaid balance will be considered as a distribution, and it will be penalized or taxed accordingly.

Need help in setting up your 401(K)?

401(k) Rollover

You can take a loan from your 401(k) plan, provided your employer approves it. If you are eligible for this option, you can borrow up to 50% of the vested balance up to a limit of $50,000. The loan usually has to be repaid within 5 years, but a longer repayment period is allowed for a primary home purchase.

The interest rate that you pay to yourself for borrowing the money from your 401(k) plan will be comparable to the interest rate charged by the banks and lending institutions for a similar type of loan.

If you fail to repay the borrowed amount, the unpaid balance will be considered as a distribution, and it will be penalized or taxed accordingly.

Need help to get started?

Resources