Maxing out your 401(k) contributions is a good thing. It means that you are making the most out of your employer-sponsored retirement account to enjoy worry-free golden years. Over contributing to your 401(k) isn’t allowed, but it’s easy to do it by mistake. If you have contributed too much to your 401(k), there are consequences that we’ll discuss in this article. Also, find out what investment options you have to park your excess funds.

Key Takeaways

Did you contribute too much to a 401(k)?

In most cases, you do not have to be concerned about over contributing to your 401(k) because your plan administrators already have a protocol in place to avoid it from happening. However, even with these mechanisms in place, there is a possibility of over contributing in a calendar year, especially if you have switched jobs and did a rollover from your previous company retirement account to a new account. If you over contribute to your retirement account, it’s difficult to find the miscalculation until it’s too late – you will end up paying tax twice on the same amount of money – you’ll get taxed on your income earned and also when you make withdrawals from your retirement account. If you want to avoid this, you need to correct the excess contributions before the tax deadline of the following year. You may have to include the dollar amount you over contributed and account for investment earnings.

401(k) Contribution Limits for 2021 and 2022

- For 2021, your individual 401(k) contribution limit is $19,500, or $26,000 if you’re age 50 or older.

- For 2022, 401(k) contribution limits for individuals are $20,500, or $27,000 if you’re 50 or older.

What should you do if you’ve over contributed to your 401(k)?

If you find that you’ve over contributed your 401(k), the first thing you should do is inform your plan administrator. Once that’s done, correcting the over contribution error may take time. Your plan administrator must distribute the excess deferral and earnings associated with these funds by a certain date as stated in the 401(k) plan. The calculation of earnings is based on the total change in account value since the over contribution. It’s important to complete this process before April 15 of the year after the over contribution is made. Once the mistake is corrected, you’ll get new tax forms from HR. You’ll receive an amended W-2. The new W-2 will reflect the increase in taxable wages, which is equal to the over contribution amount. This number must be reported to the IRS on form 1040 for the year of the corrected W-2. If you’ve filed taxes for that year already, you need to file an amended return. You’ll receive a 1099-R for the distribution of earnings associated with your over contribution. You’ll receive this in January of the year following the year the over contribution was paid back. If you don’t catch and rectify the over contribution mistake before the tax day of the year following the over contribution, your 1099-R might of a much higher amount. That’s because the 1099-R will reflect the total distribution, including the over contribution amount instead of reflecting only the earnings on the over contribution. This means you’ll be effectively taxed twice on the same income – once in the year you earned it and also in the year you corrected the over contribution. That’s not all. If you are younger than 59 ½, you’ll also be penalized a 10% early distribution penalty.

Where to put your money instead of over contributing to 401K?

Here are a few options to consider:

- Individual Retirement Account (IRA): Although IRAs offer similar benefits to a 401(k), they give you more control over your investment options. You can practically invest in everything your IRA broker offers.

- A traditional (non-tax-advantaged) brokerage account: The benefit of putting money in a traditional brokerage account is that you can use the money for whatever purpose you like. The downside is that you won’t get a tax break and will be liable for taxes on your investment gains each year.

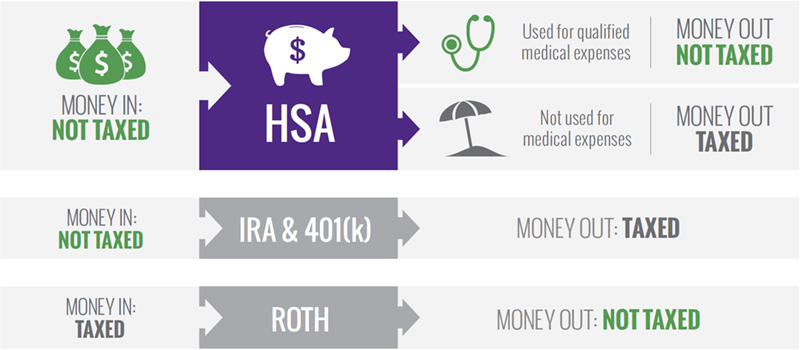

- Health Savings Account (HSA): An HSA combines both savings and investment. It allows you to set aside money that can be used to cover your healthcare expenses. Your contributions to an HSA grow tax-free.

Image credit: blog.healthequity.com

- Annuity: This is a contract made between you and an insurance company. A lump sum upfront is given to the issuer of the annuity. The issuer then agrees to pay you either a series of payments over time or a lump sum in the future.

If you have maxed out your 401(k) and still have money to spare, you are fortunate to be in a very good financial position. You can put the extra cash to good use by investing it into HSA, IRA, traditional brokerage account, or annuity – all are reasonable options. If you are worried about over contributions, get in touch with your plan administrator. If you want to discuss your worries or want to figure out the best option to invest your extra cash, get in touch with Self Directed Retirement Plans LLC.

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.