Types of 401(k) Plans

Types of 401(K) Plans

How many types of 401(k) plans are there?

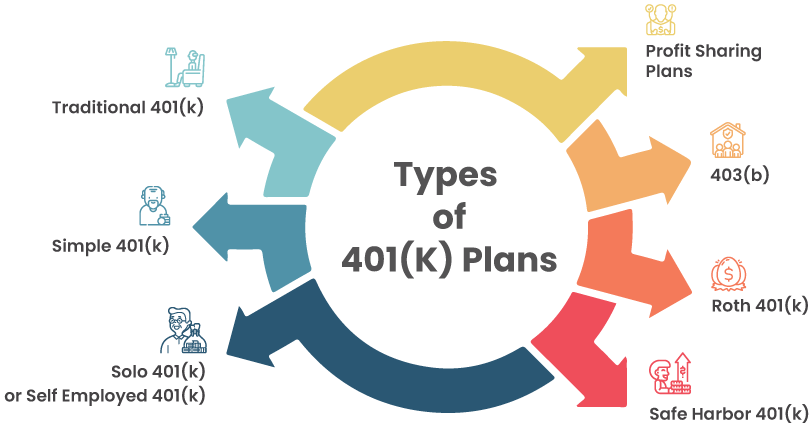

There are seven different types of 401k Plans mainly:

- Traditional 401(k) plans

- Self-directed 401(k) plan

- Safe harbor 401(k) plans

- Tiered Profit Sharing 401(k) plan

- SIMPLE 401(k) plans

- 403(b)

- Solo 401(K) or Self employed 401(K)

Different rules govern each of these plans. Below is the detailed information for each type of 401(K).

Traditional 401(k)

Many businesses choose a traditional 401(k) plan to offer retirement benefits to their employees. A traditional 401(k) is an employer-sponsored retirement plan, it also gives multiple investment options to employees. The employee contributions and any earnings from the investment in a traditional 401(k) are tax-deferred. Income taxes are applied only when the savings are withdrawn. To provide the benefit to their employees, some employers match a portion of the employees’ 401(k) contributions. The income taxes on employer matching funds are also deferred and are applied only when the savings are withdrawn.

|

Best for |

|

|---|---|

|

Key advantage |

|

|

Who can contribute |

|

|

Tax advantage |

|

Roth 401(k)

An employer-sponsored Roth 401(k) plan is similar to a traditional 401(k) plan, but it has one major exception. Unlike the traditional plan, employee contributions towards a Roth are not tax-deferred but are made with after-tax dollars. However, the income earned from the Roth account – interest, capital gains, or dividends – is tax-free. This type of 401(k) plan is ideal for people who believe that they would be in a higher tax bracket when they retire. Younger employees and high-earners can also benefit from this Roth account.

|

Best for |

|

|---|---|

|

Key advantage |

|

|

Who can contribute to Roth 401(K) Plan: |

|

|

Tax advantage |

|

Need Help selecting the best plan for you?

Contact RickSolo 401(k)/Self Employed 401(k)

A Solo 401(k) is a qualified retirement account that is specifically designed for employers who have no full-time employees apart from their spouses and partners. This type of 401(k) retirement account is also known as an Individual 401(k) or Self Employed 401(k) or Solo-K. In a Solo 401(k) retirement plan, the employer wears the hat of an employer as well as an employee. The plan allows the employer to make contributions both as an employer and an employee, thus maximizing their retirement contributions and business deductions. As the Solo 401(k) covers only the business owner(s) and their spouse(s) and parters, it is not subjected to the complex ERISA (Employee Retirement Income Security Act of 1974) rules, which restricts employer pension plans with non-owner employees by setting minimum standards. All contributions made as an “employer” are tax-deductible (subject to IRS maximums) to your business while the earnings grow tax-deferred until withdrawn.

|

Best for |

|

|---|---|

|

Key advantage |

|

|

Who can contribute to solo 401(K)/ self employed 401(K): |

|

|

Tax advantage |

|

Safe Harbor 401(k)

A Safe Harbor plan is a special kind of a 401(k) retirement plan that automatically passes the non-discrimination test. This special plan has certain built-in features that require the companies to make contributions to each employee’s 401(k) plan. The IRS rewards employers who take this step to increase employee participation with “safe harbor” from both the non-discrimination test and the consequences of failure.

|

Best for |

|

|---|---|

|

Key advantage |

|

|

Who can contribute to Safe Harbor 401(K): |

|

|

Tax advantage |

|

Simple 401(k)

SIMPLE 401(k) is an ideal retirement plan for business owners or self-employed professionals with employees less than 100. This simplified, stripped-down version of a traditional 401(k) plan is a cost-effective and efficient way to offer benefits to the employees. SIMPLE 401(k) plan is a combination of the features of a traditional 401(k) and the simplicity of a SIMPLE IRA. However, eligible employee participants of a SIMPLE 401k plan cannot receive accruals or contributions with any other employer-sponsored retirement plan. With a SIMPLE 401k, employer contributions must be fully vested.

|

Best for |

|

|---|---|

|

Key Advantages |

|

|

Who can contribute to simple 401(K) plan: |

|

|

Tax advantage |

|

Get Your ONE-on-ONE CONSULTATION

Contact UsProfit Sharing Plans

A profit-sharing plan is a type of defined-contribution plan that gives the employers the flexibility to design the key plan features of the plan while keeping the financial well-being of their employees in mind. The flexibility makes this plan ideal for businesses of any size to help their employees save for their retirement. In this type of retirement plan, the employer contributions are discretionary. That means, if the company is not making a profit, it can choose not to make the contributions to the plan.

|

Best for |

|

|---|---|

|

Key Advantages |

|

|

Who can contribute to profit sharing plans: |

|

|

Tax advantage |

|

403(b)

A 403(b) plan specifically designed for specific employees of tax-exempt charities, public schools, and churches. Eligible participants to this plan include school administrators, teachers, government employees, professors, doctors, nurses, and librarians.403(b) plan is similar to a traditional 401(k) in many ways. It allows the employees to defer a part of their salary into the retirement fund, and this deferred salary is typically exempted from income taxes, but the distributions are taxed. The 403(b) plans also offer Roth accounts, wherein the salary contributions are taxed, and distributions are tax-free. In 403(b) plans, the employers may or may not contribute to the plan. This plan allows the participants to invest in either mutual funds or annuities.

|

Best for |

|

|---|---|

|

Key Advantages |

|

|

Who can contribute to 403(b) plans: |

|

|

Tax advantage |

|

Take control of your financial future now.

Contact Us