Which is a better strategy for growing your wealth? Investing in real estate or stocks? Or a bit of both like most Americans do? The answer isn’t simple. However, understanding each type of investment will enable you to choose the best strategy to grow your money and create financial security.

Both real estate and stocks have their own set of pros and cons. Remember, many investors invest in both. If you like the idea of investing in real estate, 401(k) real estate investment might be worth a second look.

Let’s take a look at how real estate and stocks stack up against each other.

Real Estate vs Stocks

Returns

Real Estate: You are buying physical property, a piece of land, apartment, home, etc. If your property is vacant, it costs you money in terms of taxes and maintenance. But if your property is on rent, it generates rental income which you can spend on taxes and maintenance, and the rest can be considered as profit.

Stocks: When you invest in stocks, you buy the shares of a company. It’s like owning a small percentage of the company. As the company grows, the value of your shares grows too. Money is made in the stock market by buying low and selling high.

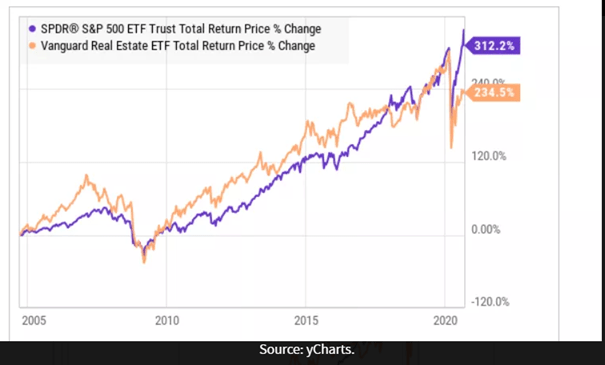

The returns of both these investments cannot be practically compared because the factors that affect values, prices and returns are very distinct. However, if we compare the total returns of the SPDR S&P 500 ETF (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) over the last 20 years, we can get a fair idea of how they perform

The chart above indicates that both real estate and stocks take big hits during economic recessions. Notice the drop that occurred during the great recession (2008) and COVID-19 (2020).

The chart above indicates that both real estate and stocks take big hits during economic recessions. Notice the drop that occurred during the great recession (2008) and COVID-19 (2020).

Risks

Real Estate: When it comes to real estate, the most important risk is investing in it without doing thorough research. Also, you cannot easily liquidate your real estate when you are in a bind. If you own rental properties, the risks usually involve handling repairs or managing rentals.

Stocks: The value of the stocks is extremely volatile, and the prices can go up and down due to market fluctuations. The stock market involves economic, market and inflationary risks. If you have an undiversified investment portfolio, you attract greater risks.

Pros and Cons

Real Estate

Pros

- Easy to understand: While the process of investing in real estate is complicated, the basic rules are simple – buy, maintain/manage, and resell at a higher price.

- Tax advantages: Real estate investors can take advantage of substantial tax benefits in terms of tax reduction or tax breaks.

- Hedge against investment: As the value of homes and rents typically increase with inflation, owning a real estate is generally considered a hedge against inflation.

- Ease of Tranzactions: With growing digitalisation making transactions has become very easy with tools such as online rent payment and affordable esignature service the hassle of online paperwork is reduced making the transactions fast and smooth

Cons

-

- More work than buying stocks: While the process of purchasing real estate is easy to understand, it demands more hard work.

- ROI isn’t guaranteed: Although the price of property rises over time, you could be at risk of selling the property at a loss; the great recession is a reminder of that.

- Expensive and liquidity-challenged: Real estate is expensive and highly illiquid. Buying real estate requires a large amount of cash as an upfront investment. It has high transaction costs. Getting money through reselling the property is also difficult. Although an asset, it’s not easy to liquidate it.

Stocks

A detailed video on trading stocks in your self directed 401K account by Tim Berry, IRA Attorney.

Pros

-

-

- Highly liquid: It’s easier to know the value of the stocks. And if you decide to act (buy or sell), you can do it almost instantly.

- Easy to add to a tax-advantaged account: Your investment can go tax-deferred or tax-free if you purchase shares through an employer-sponsored retirement account like a 401(k) or through an IRA.

- Fewer transaction fees: You need a brokerage account to buy and sell stocks. Most brokers offer no-transaction-fee or zero trading costs.

- Easy to diversify: You can build a broad portfolio of industries and companies at a fraction of the cost and time of owning a diverse range of real estate.

-

Cons

-

-

- More volatile: Stock prices are volatile. They move up and down faster than real estate prices. This volatility can be risky unless you have a plan.

- Potential for emotion-driven investing: Majority of the stock selling and buying decisions are made when the market fluctuates. If emotion, and not the strategy is the trigger, it becomes risky.

- Selling stocks can trigger big taxes: Selling stocks may attract capital gains tax. Owning stocks for more than a year also attracts taxes, but at a lower rate. When your stock portfolio pays out any stock dividends, you may have to pay taxes.

-

Both real estate and stocks offer long-term financial gain, but they also come with potential risks. While choosing the best investment strategy to grow your wealth, the best way to hedge against the risks is to diversify as much as possible.

Featured Image – Shutterstock

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.