Institutional-quality, private real estate investments used to be nearly impossible for the self-directed investor to access. Since the JOBS Act of 2012, and thanks to the advent of web-based investing platforms, professionally managed real estate and other alternative assets are now much more attainable for individuals seeking greater diversification. Meanwhile, a number of forward-looking self-directed IRA custodians have adopted more efficient processes, embraced technology, and prioritized integrating with the “platform investing” model.

What types of alternative investments can I access with a SDIRA?

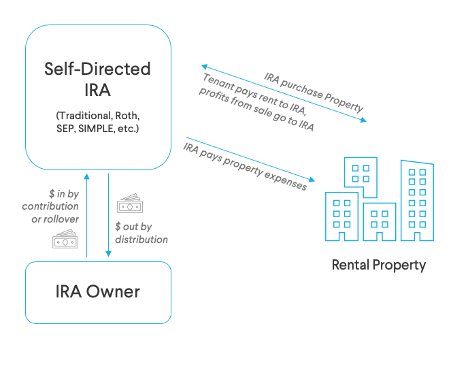

Self-directed IRA investors are legally permitted to invest in real estate, precious metals, hedge funds, or alternative assets. The only investment restrictions for IRAs are collectible items, life insurance, S-corporation stock, and prohibited party transaction (such as with family members). An IRA may leverage its investment with debt by using a nonrecourse loan to fund the balance of the investment. Online investment platforms that can accept self-directed IRA investments allow investors to passively invest in non-traded, alternative assets. Through EquityMultiple, for example, investors can access passive investments into debt, preferred equity, or equity positions in individual properties. This affords SDIRA investors a range of risk/return profiles and target hold periods.

When selecting real estate investments to allocate to via a SDIRA, many investors primarily consider their risk tolerance and time horizon with respect to retirement. Some SDIRA investors opt for payment priority — offered by debt or preferred equity investments — in advance of, or concurrent with, their target retirement date. Others seek longer-dated equity investments that will offer stabilized cash flow over a longer time horizon.

What are the best SDIRA custodians for passive real estate investing

Our more active investors typically choose a SDIRA custodian based on the following criteria:

● Fee structure

● Lack of red tape: how easy is it to obtain necessary approvals and fund investments?

● Tech integration: can the custodian interface with investing platforms to more efficiently complete investments and transfer funds?

There are a wide variety of fee structures among SDIRA custodians, so our investors will consider how frequently they plan on participating in EquityMultiple investment offerings and at what volume, seeking to minimize their aggregate transaction fee burden. The pros at Self Directed Retirement Plans, LLC can help you determine which custodian will be best given your investment objectives. Self Directed Retirement Plans LLC uses only “passive” custodians.

We also take the process a step further. We have been creating self directed IRA’s for over 15 years and ALL of our IRA clients benefit from “the next step. SDIRA’s are allowed to invest in LLC’s. We create underlying LLC’s for every SDIRA client. We structure the LLC’s as follows: they are manager managed LLC’s and our clients are the managers. The passive custodian is the member of the LLC FBO the IRA. We assist our IRA clients to establish a checking account in the name of the LLC. We then help our clients transfer all but $500 from the IRA account to the new LLC checking account. Our clients enjoy complete checkbook control, the passive custodian is truly passive and has no say on the day to day activities. This eliminates the above mentions aggregate transaction fees, asset based fees and saves time.The LLC basically has one purpose – to be the investment arm of the IRA.

How do investors use their SDIRA to invest in professionally managed R E investments such as EquityMultiple real estate offerings?

EquityMultiple facilitates investing in any of our investment offerings through a self-directed IRA: a custodian that allows real estate held in custody. With EquityMultiple and some other investing platforms, investors can rollover funds or fund this SDIRA directly. You will typically be required to instruct the custodian of your IRA to complete a written instruction, often known as a “buy direction” form attesting your (the beneficiary’s) intent to purchase an interest in this investment by the custodian (trust). The custodian will subsequently review the offering material or purchase agreement so that it doesn’t constitute a prohibited transaction. Lastly, the custodian countersigns the documents and wires proceed to the entity formed. Income, rental expenses, and sale from the asset are directed to the SDIRA and not directly to the beneficiary. The above is very true for most SDIRA’s. However, taking our “extra step” dramtically reduces the custodial expense and interference!

Tax Implications of SDIRA Real Estate Investing

A SDIRA account that invests passively in certain types of real estate asset can be subject to Unrelated Business Income Tax (UBIT). UBIT tax typically applies only when an IRA receives ordinary income as opposed to passive income from the investment held in custody. Passive income such as interest, rental income, dividends, or capital gain income is generally exempt and not subject to UBIT. There are two main instances where UBIT may apply:

If the real estate constitutes an income-producing business: UBIT tax is due if the real estate produces a service or product (for example a car wash, a hotel, or a restaurant.) If the intent was to sell immediately after purchase, then the investment can be subject to UBIT tax. Typically this timeframe is defined as less than one year.

Development: If the real estate activity is a ground-up development or a value-add investment that entails significant property improvements. In this case, a property that goes from land to structure and is sold will be required to pay UBIT tax.

When using the self-directed IRA in a transaction that will trigger the UBIT tax, the IRA is taxed at the trust tax of 10% – 37%. We encourage investors to consult with a tax advisor or IRA tax specialist to determine the tax implications of any particular real estate investment.

At Self Directed Retirement Plans LLC we also create self directed checkbook controlled 401 k plans. In fact we do 20 times more SD Plans the SDIRA’s. Ninety percent of our new clients wish to invest in RE using their retirement dollars. We ask two simple questions, Do you have any type of self employed income AND Do you have any fulltime employees. Self employed income can be consulting, Mary Kay, cleaning swimming pools etc. It is very easy to create self employed income.

We steer almost all IRA “callers” into SD 401 k clients. There are many reasons but a big difference is”. Real Estate investments using leverage (non recourse loans) in a SD 401 k DO NOT attract UBIT. This is absolutely HUGE. As stated above this eliminates the trust tax of 10% to 37%. When you combine using a ROTH sub account in the SD 401 K and leverage for R E investments you basically eliminate all taxes.

Feature image credit: @jcomp

Rick Pendykoski is the owner of Self Directed Retirement Plans LLC, a retirement planning company based in Goodyear, AZ. He has over three decades of experience working with investments and retirement planning, and over the last ten years has turned his focus to self-directed ira accounts and alternative investments. If you need help and guidance with traditional or alternative investments, call him today (866) 639-0066.