Table of Contents

Save thousands each year, and gain control of what's yours.

Join our newsletter

to get trending content!

Key Takeaways

- Controlled group rules decide whether multiple businesses are treated as one employer for Solo 401(k) purposes, which directly impacts eligibility and compliance.

- A Solo 401(k) is only allowed when none of the businesses in the controlled group employ full-time workers (other than a spouse). One full-time employee in any entity disqualifies the entire group from using a Solo 401(k).

- All controlled group companies must follow the same retirement plan structure, meaning owners may need a standard 401(k) or Safe Harbor 401(k) if workers exist in any connected business.

- Contribution limits apply across all controlled group businesses combined. It prevents owners from using multiple entities to increase annual Solo 401(k) contributions.

If you own more than one business, you may wonder whether you can still use a Solo 401(k) plan. The answer depends on whether your businesses are treated as a controlled group under IRS rules. These rules decide if your companies must be viewed as one employer for retirement plan purposes.

This guide breaks down what a controlled group Solo 401(k) plan is, why it matters, and how to stay compliant so you can protect your plan and avoid IRS issues.

What is a Solo 401(k) Plan?

A Solo 401(k) plan is a retirement plan designed for self-employed individuals and business owners who have no full-time employees except a spouse. It allows you to contribute both as the employer and employee. Thus, it helps you save more compared to other plans.

Want the complete rundown on the Solo 401(k) plan structure? Read Our Complete Guide

What Is a Controlled Group?

A controlled group exists when the IRS determines that multiple businesses are effectively under the same ownership or control. When companies fall into this category, the IRS treats them as one employer for retirement plan rules. This matters because if any business in the group employs full-time workers, all companies in the group lose Solo 401(k) eligibility.

Types of Controlled Groups

-

Parent-Subsidiary Controlled Group

This happens when one business owns 50% or more of another company.

-

Brother-Sister Controlled Group

This involves two or more businesses owned by the same person or group of people, meeting specific ownership and control tests:

- The same five or fewer individuals own 50% or more of each business.

- They have “effective control,” meaning identical ownership of more than 50%.

-

Combined Controlled Group

A mix of the above types is a combined controlled group. For instance, you own more than 50% of Company A, Company A owns 50% of Company B, and you also own a portion of Company C.

-

Family Attribution Rules

The IRS may “attribute” ownership among family members, including spouses, parents, and minor children. If your spouse owns 100% of a company, the IRS may treat you as owning it too.

What is the Impact of a Controlled Group on a Solo 401(k)?

If your businesses fall under a controlled group, the IRS treats them as a single employer for retirement plan purposes. The main impacts include:

- Solo 401(k) Eligibility Changes: The plan is no longer allowed if any company in the group has a full-time employee.

- Shift to a Standard 401(k): You may need a plan that covers all eligible employees across every connected business.

- Combined Contribution Limits: Your total compensation from all controlled group businesses is used to calculate a single annual contribution limit.

- Unified Plan Oversight: All companies are expected to follow the same plan structure to avoid compliance issues.

In short, controlled group status can eliminate Solo 401(k) eligibility and increase administrative requirements.

What are the Key IRS Rules for Controlled Group Compliance?

The IRS enforces controlled group rules to ensure business owners do not use multiple entities to bypass employee coverage requirements. These rules determine when companies must be treated as one employer:

-

Common Ownership and Control Tests Apply

The IRS evaluates ownership percentages, voting control, and family attribution to determine whether businesses are connected.

-

Employees Must Be Counted Collectively

Any full-time employee in any entity must be included when determining retirement plan eligibility.

-

Family Attribution Can Create a Controlled Group

Spouses, minor children, and certain relatives may be treated as owners. Sometimes, linking companies unintentionally.

-

One Combined Contribution Limit

Since controlled group companies are treated as one employer, owners cannot use separate entities to inflate contributions.

-

A Single Plan Must Cover the Entire Group

If the structure requires a full 401(k) plan, it must universally apply to all eligible employees across all companies.

How Can You Set Up and Ensure Compliance for a Controlled Group Solo 401(k) Plan?

If your businesses form a controlled group, your retirement plan must be set up correctly to meet IRS requirements. This prevents plan disqualification and protects your tax-advantaged status.

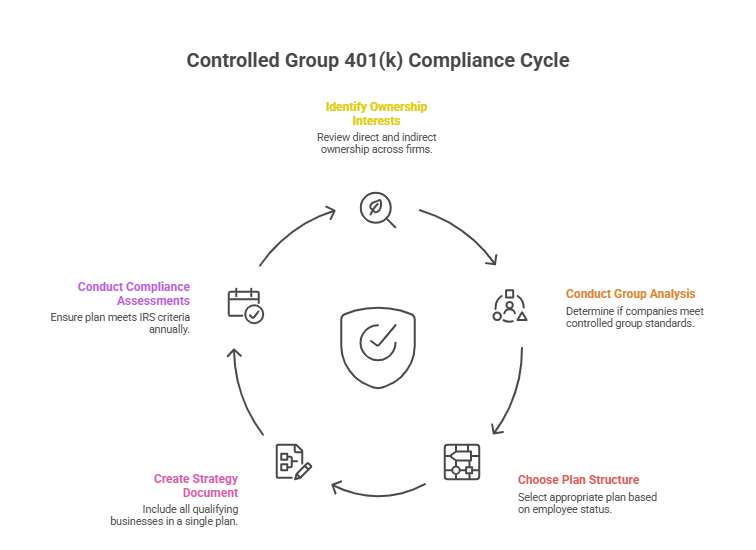

Steps to Ensure Compliance

-

Identify all Ownership Interests

Review direct and indirect ownership across all firms you control. Add family attribution guidelines.

-

Conduct a Controlled Group Analysis

Use IRS guidelines or contact a specialist to determine whether your companies meet controlled group standards.

-

Choose the Proper Plan Structure

If there are no employees in any business, a solo 401(k) is still permitted. If any firm has employees, you may require a Traditional 401(k) or Safe Harbor 401(k) that insures everyone.

-

Create a Single, Cohesive Strategy Document

All qualifying businesses in the controlled group must be included under the same plan.

-

Conduct Yearly Compliance Assessments

Annual testing ensures your plan fulfills IRS coverage and non-discrimination criteria.

Pros and Cons of a Controlled Group 401(k)

A controlled group setup has its own benefits and challenges. Check them out here:

Pros:

-

Consistent Retirement Savings

You can streamline retirement planning across multiple businesses.

-

Increased Contribution Limits

Income from all controlled group businesses can support higher employer contributions.

-

Tax Benefits

Unified plans may offer additional deductions and smoother tax planning.

Cons:

-

Compliance Complexity

Solo 401(k) controlled group rules are detailed and require careful analysis.

-

Higher Administrative Costs

More businesses and employees usually mean more testing, documentation, and service fees.

-

Potential Loss of Solo 401(k) Status

If employees exist anywhere, Solo 401(k) eligibility ends.

Final Thoughts: Is a Controlled Group Solo 401(k) Plan Right for You?

A controlled group Solo 401(k) can work well if you own multiple companies with no full-time employees across any entity. But if you employ workers in any business, you need another type of retirement plan to stay compliant.

If you are unsure whether your companies form a controlled group, it’s best to get a professional review. The right structure can protect your tax benefits and keep your retirement plan in good standing.

Need help analyzing your ownership structure or setting up the right 401(k)?

Talk to a specialist at Self-Directed Retirement Plans LLC today.

FAQs

If I own several firms, can I still have a Solo 401(k)?

Yes, but only if none of the companies you own have full-time employees (except for your spouse). Otherwise, you may be obliged to choose a regular 401(k) plan.

What happens if I disregard the rules of the controlled group?

Failure to comply can result in plan disqualification, IRS penalties, and taxable distributions. Before opening or making contributions to a Solo 401(k), it's critical to evaluate your ownership structure.

Are family-run companies inherently governed?

Family attribution rules may be applicable, but not always. For example, ownership can be divided between parents and minor children or between couples.

How can I find out if my companies belong to a controlled group?

You need to apply the IRS’s ownership and control tests or consult a certified tax advisor or ERISA attorney to do a full study.

Can I restructure my businesses to preserve my Solo 401(k)?

Yes, possibly. You may be able to separate your Solo 401(k)-eligible business from others through entity restructuring or ownership changes. But you should always do this with expert legal and tax assistance.

How do contributions work in a restricted group Solo 401(k)?

All contributions from all enterprises in the controlled group count against the yearly Solo 401(k) contribution limitations combined.

Can I modify a Solo 401(k) plan that was set up incorrectly?

Yes, but it demands corrective action, maybe including plan termination or conversion to a full 401(k). Seek expert help.

What if my spouse works for one of my businesses?

Spouses are allowed in Solo 401(k) plans. However, the plan can be invalidated if there are additional employees.