Table of Contents

Save thousands each year, and gain control of what's yours.

Join our newsletter

to get trending content!

Key Takeaways

- An EIN becomes essential if your plan needs its own bank or brokerage account, reaches 250,000 dollars in assets, or uses alternative investments.

- Most Solo 401(k) plans benefit from having a separate EIN, especially for banking, reporting, and trust identification.

- Using an EIN keeps personal and plan assets clearly separated, which improves compliance, reduces errors, and simplifies IRS reporting.

- Getting an EIN is fast, free, and done directly through the IRS website. Setting up your Solo 401(k) trust correctly from the start is extremely easy.

- Skipping the EIN can lead to administrative headaches, including difficulties opening accounts, filing Form 5500 EZ, and maintaining clean audit trails.

If you are thinking about setting up a Solo 401(k), one question often comes up early in the process: “Do I need an EIN for my Solo 401(k)?” The short answer is yes, you do need an EIN for your Solo 401(K). You can sometimes start a Solo 401(k) without a separate EIN, but getting one is usually the smarter and cleaner option.

In many situations, it becomes necessary for smooth banking, IRS reporting, and long-term compliance. This guide breaks everything down in simple language, so you can understand when an EIN is required, why it matters, and how to set it up.

What is an Employer Identification Number (EIN)?

An Employer Identification Number is a nine-digit number issued by the IRS (Internal Revenue Service). It works like a Social Security Number for a business or trust and is used to identify the Solo 401(k) plan for banking and reporting purposes.

Why Does a Solo 401(k) Might Require an EIN?

A Solo 401(k) is both a retirement plan and a trust. Since a trust is treated as a separate legal entity, many financial institutions prefer or require an EIN to differentiate your personal finances from your plan assets.

When Getting an EIN is Especially Important?

Although a Solo 401(k) can sometimes function without one, you should strongly consider getting an EIN if any of the following apply:

-

You Want to Open a Bank or Brokerage Account for the Plan

Your Solo 401(k) needs its own checking or brokerage account because investments must be made in the plan’s name rather than your own. Many banks don’t open these accounts if the plan does not have an EIN. The EIN proves that the retirement trust exists and is separate from your personal identity.

-

Need to Stay Compliant When the Plan Grows Past Reporting Thresholds

Once plan assets reach or exceed $250,000, you must file Form 5500 EZ each year. An EIN makes this process smooth because the form asks for a tax identification number for the plan. Without one, the filing becomes confusing and may cause errors or delays.

-

To Support Alternative Investments That Require Clear Trust Separation

If your Solo 401(k) invests in real estate, private placements, promissory notes, or other non-traditional assets, a separate EIN is helpful. These investments often involve contracts, deeds, or legal documents that require the trust to be clearly identified. An EIN helps create that clear line of separation between you and the plan.

-

If Your Business Structure Becomes More Complex

If you operate as an LLC or S Corporation, or if you hire your spouse into the business, the need for separation grows stronger. A Solo 401(k) trust with its own EIN creates cleaner records and reduces the chance of mixing personal, business, and retirement funds.

-

For a Stronger Audit Trail and Easier Administration

Having an EIN reduces administrative issues, simplifies banking, and lowers the risk of compliance mistakes. It gives the plan its own identity, which helps avoid confusion during audits, custodian reviews, or IRS inquiries.

How Can You Set Up an EIN for Your Solo 401(k)?

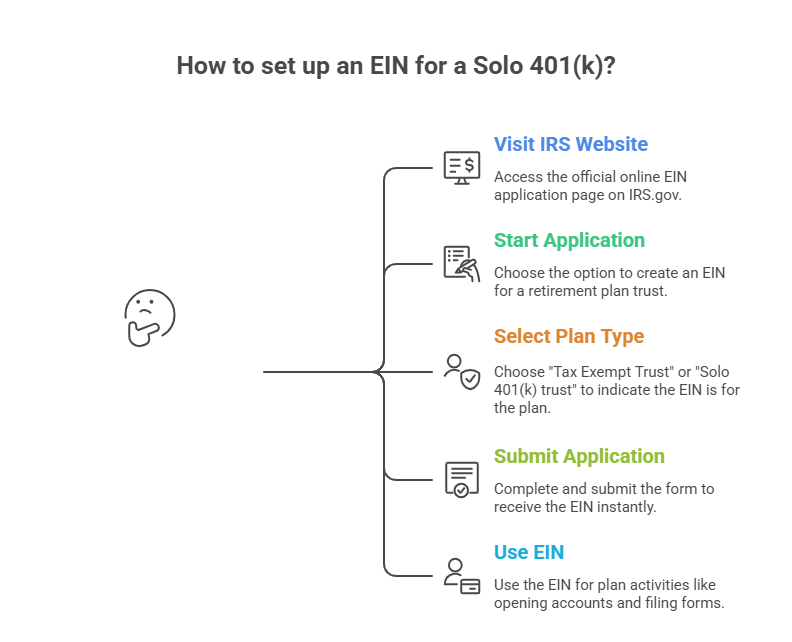

Setting up an EIN is simple and free. The entire process takes only a few minutes on the IRS website. Here is a step-by-step breakdown:

Step 1: Go to the IRS Website

Visit the online EIN application page on IRS.gov. This is the official and only place to get an EIN at no cost.

Step 2: Start the Application

Choose the option to create an EIN for a retirement plan trust. The form guides you through basic questions about your plan.

Step 3: Select the Correct Plan Type

When asked what kind of entity you are applying for, choose “Tax Exempt Trust” or “Solo 401(k) trust”, depending on the available options. This indicates that the EIN is for the plan and not your personal business.

Step 4: Submit the Application

Once you complete the questions, submit the form. The IRS issues your EIN instantly. You can download and save the confirmation letter.

Step 5: Use Your EIN for Plan Activities

Use the EIN to open a bank or brokerage account, file future forms, and keep plan activities separate from your personal finances.

What Happens if You Do Not Get an EIN for Your Solo 401(k)?

Not having a separate EIN does not automatically disqualify your plan, but it can create challenges. Here are the most common issues.

-

Difficulty Opening or Maintaining Accounts

Banks and brokers often require a trust EIN to open an account in the plan’s name. Without it, you may be unable to hold investments correctly.

-

Confusion During IRS Reporting

When you need to file Form 5500 EZ or report distributions later, having no EIN makes the paperwork more complicated. It can also create mismatched records in IRS systems.

-

Risk of Mixing Personal and Plan Assets

Using your SSN for everything makes it harder to keep the trust separate from your personal funds. This can raise compliance concerns or audit issues.

-

Missed Filing Obligations as the Plan Grows

If your assets exceed $250,000 and you do not already have the EIN and trust structure set up, filing may be delayed or incorrect.

-

Increased Administrative Burden

A plan without a clear trust EIN is simply harder to manage. Financial institutions may request extra documents, and small errors can turn into larger problems later.

Still not sure if you need an EIN for your Solo 401(k)?

FAQs

Can I use my Social Security Number instead of an EIN?

Yes, some plans allow you to start with your SSN, especially if you are a sole proprietor.

However, you still need an EIN once you open a bank account or reach IRS reporting thresholds.

Do I need an EIN if my business already has one?

You may be able to use your business EIN for the plan. Even so, many experts recommend getting a separate EIN for the Solo 401(k) trust to keep everything clearly separated.

When do I file Form 5500 EZ?

You must file Form 5500 EZ if your Solo 401(k) has more than $250,000 in assets at the end of the year.

Can I wait until my plan grows before getting an EIN?

You can, but most people find it easier to set up the EIN at the beginning. Doing it early avoids complications when opening accounts or filing later.

Is getting an EIN free?

Yes, the IRS issues EINs at no cost.

Does an EIN change my tax liability?

No. An EIN is only an identification number. It does not change how your contributions or distributions are taxed.