Self Directed IRA LLC

What is a Self-Directed IRA LLC?

A Self-Directed IRA LLC is a way to have control over your retirement account. It is a type of custodial account, meaning you are the owner of the business and can do with it what you want.

A self-directed IRA LLC allows you to invest in anything from real estate to private equity, as well as traditional investments like stocks and bonds. You have total flexibility when it comes to managing your own IRA assets.

When you open a Self-Directed IRA LLC, you can control the investment decisions for your retirement account. You can make purchases anytime without interference from your financial advisor or broker, which makes this option ideal for those who want full autonomy over their investments.

How does an IRA LLC Work?

LLCs are established under state law. Consequently, each state sets its initial and annual fees. For example, California demands an $800 annual LLC fee while Arizona has no annual fee. There are other peculiar requests depending on the state. An LLC can be taxed differently depending on how it is structured. For example (for federal tax), it can be likened to a corporation that offers two important facets – liability protection and the option to be taxed as a partnership.

Pass-through is also a unique feature of LLCs. What this means is the LLC itself is not taxed, that liability is passed on to the owners of the LLC. A single-member LLC is taxed as a sole proprietorship, while LLCs with more than one member can be taxed as a partnership. This means taxable gains and losses are passed through to the owners of the LLC. The owners are liable for the taxes or credits. This is one reason why LLCs “owned” by an IRA have become very popular.

LLCs have managers and members. When we structure an LLC, it is a manager-managed LLC. The member is the IRA custodian and, has no say in the day-to-day activities of the LLC. So, you don’t have to keep asking the custodian to transfer money, collect rents, pay a handyperson, etc. You have complete control.

What Are The Benefits of Investing through an LLC?

An LLC is a hybrid form of business structure, which means that it can be both a corporation and a partnership. An LLC is often used by self-employed individuals and small businesses who want to set up an independent business that benefits from the tax benefits of a corporation.

The benefits of investing through an LLC are pretty similar to those of investing through a corporation. For example, investors in an LLC can take advantage of financial planning advice and other services offered by the company itself. In addition, investors have access to the same level of benefits and protections as shareholders in a public company.

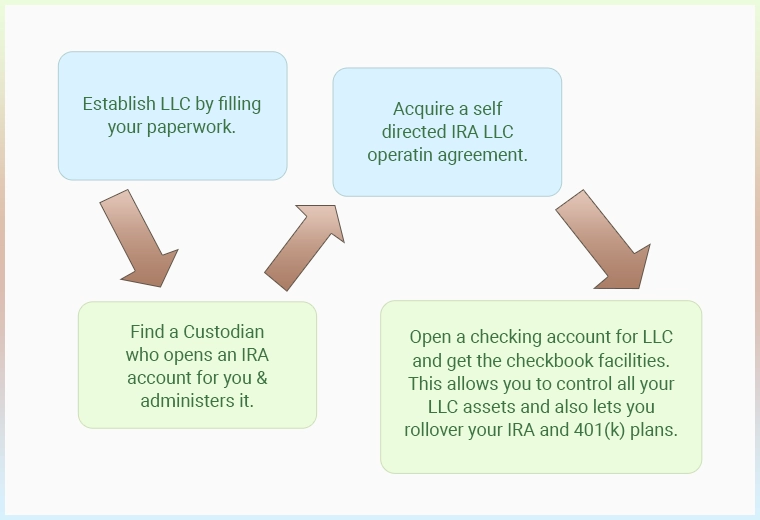

How to Establish an LLC?

The first step in establishing an LLC is deciding which state will be your LLC’s beneficial owner, or “BOD.” The BOD is responsible for filing papers with the state, paying annual fees and taxes, and operating the business.

To choose a state as your BOD, you must have a physical presence in that state. You cannot choose a state to be your BOD if you have no employees or no office in that state. Once you’ve determined where your LLC will be established, you’ll need to apply for an LLC license in that state.

The next step is to hire a lawyer or accountant who can help with forming and operating your new business. Most states require that one person serves as the registered agent for each company it creates — this person is responsible for receiving notices from investors, creditors, and others who need to contact your company — so make sure you have someone lined up before making any major decisions about your new business entity!

LLC Investment Options

The first option is to invest in a traditional IRA. This is an investment account that allows you to make regular contributions. However, it’s still subject to the same rules as other retirement accounts: you can’t withdraw the money until you reach a certain age, and then only subject to the IRS 10 percent penalty.

The second option is to open a Self Directed IRA LLC (SDI). In this case, you have unlimited investment options and are free to manage your own investments as needed. This is a good option if you want more flexibility than traditional IRAs offer, or if you want to avoid paying taxes on investment income.

Rules For Investing Through an LLC

An LLC is a limited liability company that offers tax benefits and personal protection to its members. The LLC is owned by one or more members and managed by a manager. There are no specific rules for investing through an LLC, but you should follow some general guidelines.

The most important rule to remember when investing in an LLC is that it’s best not to put all your eggs into one basket. You should diversify your investments by investing in different types of businesses within your state or across states. For example, if you live in California, you could invest in real estate companies in California and companies that produce products in California or in other states. Also, make sure that each investment fits with your goals and objectives.

Tax Considerations for LLC

The first thing to understand about an LLC is that the taxes are different from the taxes that you would pay if you were an individual. The IRS treats an LLC just like a corporation when it comes to taxes, but there are two main differences:

First, LLCs don’t pay income tax on outside business income. Instead, they’re allowed to report their profits as “pass-through income” on their personal tax returns, which means that this profit goes directly to the owners and isn’t taxed at all (though they can still deduct any losses from their personal returns).

Second, most states treat LLCs differently than corporations for purposes of paying state taxes. In particular, many states have special rules for LLCs that allow them to avoid double taxation (whereby state and federal taxes are paid twice over).

As you can see, the self directed IRA LLC removes the custodian from decision making, saves spurious fees, gives total checkbook control and puts the financial reins back into your hands.

At Self Directed Retirement Plans LLC, we take pleasure knowing we help educate and professionally establish true self directed IRA’s allowing our clients to reach as high as they can dream.